Get the free form 8288

Show details

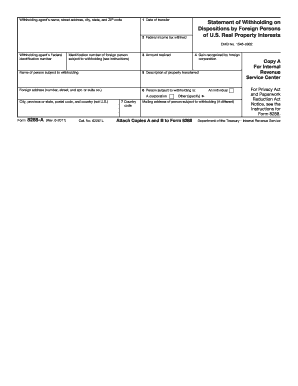

A copy of Form 8288 filed and proof of payment 3. A copy of a withholding certificate issued by the IRS plus a copy of Form 8288 and proof of payment of any amount required by that certificate 4. Yes No Check the box to indicate the reason a withholding certificate should be issued. See the instructions for information that must be attached to Form 8288-B. Signature For Privacy Act and Paperwork Reduction Act Notice see the instructions. Title if applicable Cat. No. 10128Z Date Form 8288-B...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 8288 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8288 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 8288 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 8288. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out form 8288

How to fill out form 8288:

01

Begin by obtaining a copy of form 8288 from the IRS website or your local tax office.

02

Fill in your personal information including your name, address, and taxpayer identification number.

03

Provide details about the property being sold, including the address and the date of sale.

04

Calculate the amount of withholding tax required and enter it in the appropriate section.

05

Attach any necessary supporting documents, such as a copy of the sales contract or settlement statement.

06

Review the completed form for accuracy and make any necessary corrections.

07

Sign and date the form before submitting it to the appropriate tax authority.

Who needs form 8288:

01

Individuals or businesses who are purchasing real estate property from a foreign person or entity.

02

Sellers who are non-resident aliens or foreign corporations that are subject to withholding tax on the sale of U.S. real property interests.

03

Buyers who are responsible for withholding the required amount and remitting it to the IRS.

Note: It is advisable to consult with a tax professional or refer to the instructions provided with the form for specific guidance on filling out form 8288.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

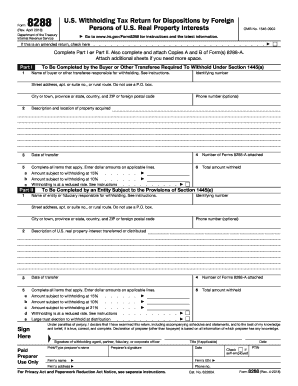

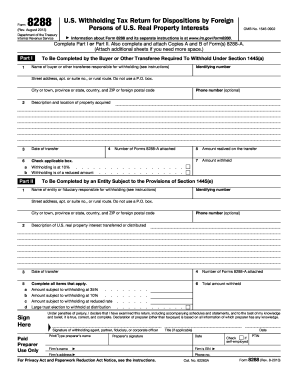

What is form 8288?

Form 8288 is a U.S. tax form titled "U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests." It is used to report and pay the withholding tax on the sale or disposition of U.S. real estate or other U.S. real property interests by foreign persons. The form helps ensure that foreign individuals or entities pay the appropriate amount of tax in the United States when they sell or dispose of U.S. real property interests.

Who is required to file form 8288?

Form 8288, also referred to as the U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests, needs to be filed by both the buyer (transferee) and the seller (transferor) in certain transactions involving the disposition of U.S. real property interests by foreign persons. The buyer or transferee files Form 8288 to report and pay the withholding tax, while the seller or transferor files the form to confirm that they are exempt from withholding or to claim for a reduced withholding amount.

What is the purpose of form 8288?

Form 8288, also known as the U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests, is used to report and withhold taxes on the sale or disposition of a U.S. real property interest by a foreign person or entity.

The primary purpose of Form 8288 is to ensure that any applicable withholding tax obligations are met by the foreign seller or transferor when they dispose of U.S. real property interests. The form is submitted to the Internal Revenue Service (IRS) to report the transaction and calculate the amount of tax to be withheld.

This form is important as it helps the IRS track and enforce tax compliance by foreign individuals or entities that sell or dispose of U.S. real property interests. The withholding tax serves as a mechanism to collect taxes on the gain or profit made by the foreign seller, even if they do not have a U.S. tax presence.

In summary, the purpose of Form 8288 is to report and withhold taxes on the sale or disposition of U.S. real property interests by foreign individuals or entities to ensure compliance with U.S. tax laws.

What information must be reported on form 8288?

Form 8288 is used to report and withhold tax on the disposition of U.S. real property interests by foreign persons. The following information must be reported on Form 8288:

1. Identification Information: The name, address, and taxpayer identification number of the seller or transferor of the U.S. real property interest.

2. Description of the Property Interest: Details about the U.S. real property interest being disposed of, including the address, type of property, and the date of disposition.

3. Gross Proceeds: The total amount received by the seller or transferor from the disposition of the U.S. real property interest.

4. Withholding Amount: The amount of tax withheld from the gross proceeds. This is typically 15% of the total gross proceeds, but it may vary depending on certain circumstances.

5. Withholding Agent Information: The name, address, and taxpayer identification number of the withholding agent responsible for withholding the tax. This is usually the buyer or the buyer's agent.

6. Certification of Non-Foreign Status: The withholding agent must certify whether the transferor is a U.S. person or a foreign person for tax purposes. If the transferor is a foreign person, the withholding agent must also provide the transferor's country of residence.

It is important to note that additional documentation and forms may be required depending on the specific circumstances of the transaction.

When is the deadline to file form 8288 in 2023?

The deadline to file Form 8288 for 2023 is generally the 20th day after the date of transfer, according to the instructions provided by the IRS. However, tax deadlines may vary based on different factors, so it is always recommended to refer to the most current information and consult with a tax professional or the IRS for specific deadline details.

What is the penalty for the late filing of form 8288?

The penalty for the late filing of form 8288, which is the U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests, depends on the duration of the delay. If the form is filed late, but within 30 days of the due date, the penalty is $100 or 10% of the amount of tax required to be shown on the return, whichever is greater.

If the form is filed more than 30 days after the due date, but before August 1st, the penalty increases to the lesser of $100 or 10% of the tax due per month (or fraction thereof) that the return is late.

If the form is filed on or after August 1st, the penalty is the lesser of $100 or 10% of the tax due per month (or fraction thereof) that the return is late, up to a maximum penalty of 50% of the tax due.

It's important to note that these penalties apply to late filing, not late payment of the tax. Additionally, there may be interest charges for late payment of the tax owed.

How can I modify form 8288 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including form 8288. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I sign the form 8288 electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your form 8288 in minutes.

How do I complete form 8288 on an Android device?

Use the pdfFiller mobile app to complete your form 8288 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your form 8288 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.